Here the extract and the full NBR article of 30 November 2017 on HLL FKA's PFC#13. It includes some some commentary from FKA's CCH.

Suse Reynolds, AANZ & Andrew Moorby, EY

With 10+ taking this up from FKA ranks alone this should be great angelic get together. Thank you to Suse and Andrew for putting this together.

Let's welcome Marisa Fong to the FKA family. Despite a lot of digging no dirt has surfaced on her, not even Lance Wiggs, Founding Director of the Punakaiki Fund could, and he sent his brief best wishes "Marisa Fong is good people btw."

Very interesting findings from a new comprehensive survey of US angel investors. Compulsory Xmas reading for angels!

A controversial cryptocurrency offering by an Auckland teen has been withdrawn, four days after the Herald reported possible misrepresentations in offer documents and the flagging of official concern by the Financial Markets Authority.

A Herald investigation found the offer document made claims that appeared to inflate traffic and economic activity on Sell My Good by up to four orders of magnitude. Instead of 10,000 new listings a day, the site only displayed 17 in the past month.

More background on recent developments at StretchSense. Much of which was being kept under wraps whilst the deal was progressing over recent months. Thank you to all FKAngels in LP1 and to all co-investors for observing strict confidentiality.

Special thanks to Ralf Muller, Heath Milligan, John Newton, Chris Sattler and Rudi Bublitz for helping hands on to make StretchSense successful.

Get in touch with Angus Bow who was part of the original StretchSense DD Team. He loves deep IP and Kiwi company Wing Acoustics has plenty of it. He is organising a hearing in Takapuna, Friday 1 December.

Suse Reynolds, AANZ & Andrew Moorby, EY

With 10+ taking this up from FKA ranks alone this should be great angelic get together. Thank you to Suse and Andrew for putting this together.

Option 3 "Drinks with Suse and Andrew" won over "Black Water Rafting". Impressive still how many FKAngels are up for a Sunday 6am start to get wet. However, December is just too busy an so Tim Gelston our CPA ᴄʜɪᴇꜰ á´˜á´€Ê€á´›Ê á´€É´Éªá´á´€á´›á´‡á´œÊ€ has decided to get everyone wet to mark the start of the 2018 angel investing season.

This is our last pitch night in 2017 and the first to celebrate an exit.

Better be there! We'll have no new investment pitch. We have only one active DD Team lead by Garth on FileInvite. What a year it has been, Josh and Tim will do a double act and sum it up. Hengjie from Kami will give a brief update and may have one other.

Marisa Fong has spoken with Josh, Uli and Katheren. They all feel that there is a good mutual fit for Marisa to join FKA. However, if anyone knows of any skeletons in her closet or otherwise that speak against her joining, now is the time to speak up. In strict confidence, please email the FKA directors.

In the theme park of finance, angel investing is the fun house.​</> © Já´ÊœÉ´ Há´œsá´›á´É´ism #001 ​</>

​Rudi attended the Return on Science Physical Science investment committee meeting. Very interesting including new tech in the service robotics space as illustrated in the above video.

It's a great way for FKAngels to find early IP prospects. This is where Ralf found StretchSense. Also good to learn from the more frequent ROS investment decisions and bring that insight back to our angelic decisions. ​☞ Talk to Rudi if you're interested.

This photo was taken at the StretchSense FPC#01 AGM that brought a lot of good news. Spot the 3.5 FKAngels above. Our investor rep Chris Sattler attend the AGM but did not fit on the lens. As it is now virtually impossible to get all 100+ SS staff on a single picture this photo was also reused in a recent post announcing that SS was the 7th fastest Kiwi growing company in 2017. This awesome team reckons to make #01 in 2018.

It’s been a busy and rewarding year for the early stage investment community as we celebrate a decade of ‘doing deals’. Gratifyingly we are also beginning to see some of the ventures we have backed achieve success with a number of recent exits.

FKAngel Tim Gelston is man of many talents, one of them being parties. So no wonder than that FKA's CCH picked on him to organise a White Water extravaganza after last year's muddy affair.

Tim will fix a date and other modalities to get back with more info next week. Thanks Tim, we all love you for it â£ï¸ LOL, if big ACA can write 'Devember' then little FKA can tolerate the odd typo.​</>

READ ➤ What makes a CEO 'exceptional'? McKinsey Quarterly, April 2017

Interesting but do stats near the midpoint really say that much? CHH

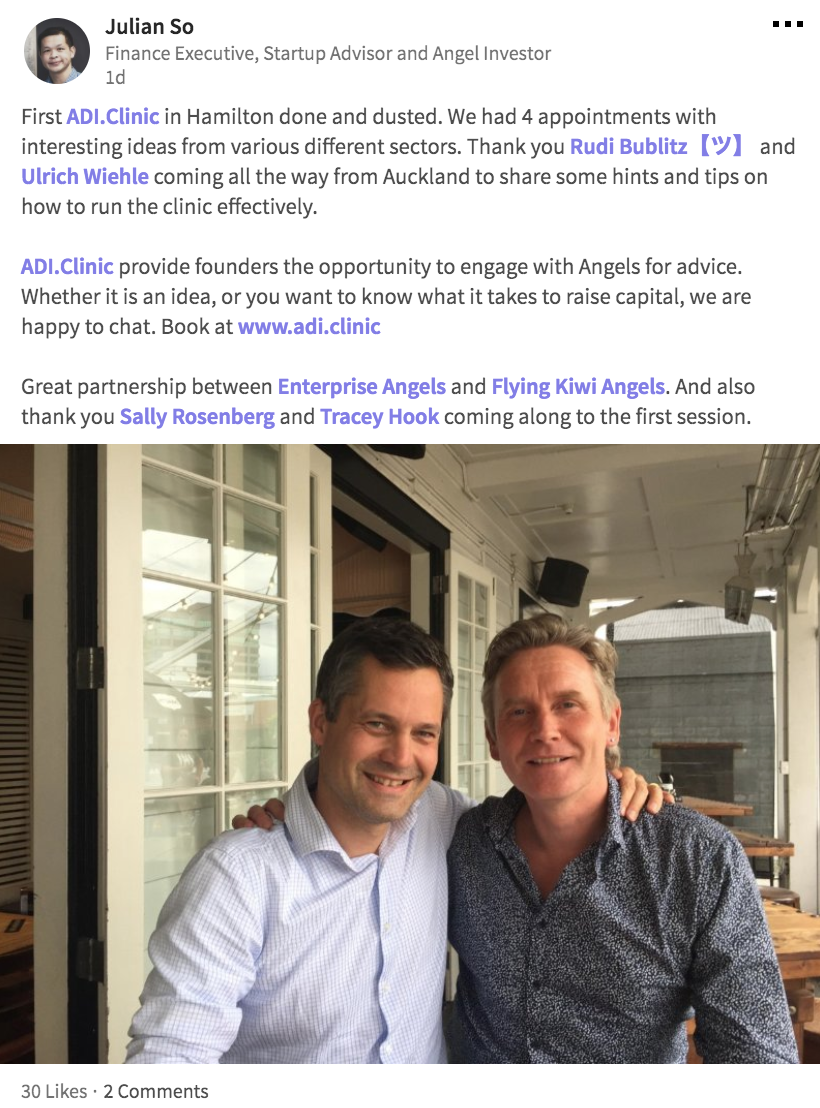

After four sessions in Hamilton we had another four sessions on Thursday in Auckland. This mentor team consisted of Garth, Rudi, Tim and Uli.

For next week we have already bookings on Monday in Wellington, on Wednesday in Takapuna and on Thursday in Auckland.

We have a new poster design to advertise ADI.Clinic. We want to make sure that in 2018 everyone in the startup ecosystem knows about our ADI.Clinic venues and times so we can help founders early.

See below the Annual Report 2017 from the Angel Association. CCH Rudi Bublitz attended the AGM and subsequent council meeting for FKA. He proposed a review of current commission mechanics in order to remove syndication friction between domestic startup investors and foreign investors. A lively debate ensued and the topic will continue in the new year.

|

CategoriesArchives

July 2024

|

RSS Feed

RSS Feed